AML Audit NZ Cost Estimate

This form is used to collect certain information about your business for the purpose of providing a cost estimate for an audit under Section 59 of the Anti-Money Laundering and Countering Financing of Terrorism Act.

What should you expect from an AML/CFT audit?

Establishing Customer Risk Ratings

Streamline Compliance

AML360™ software is configured by AML/CFT compliance professionals to automate risk-based monitoring and reporting.

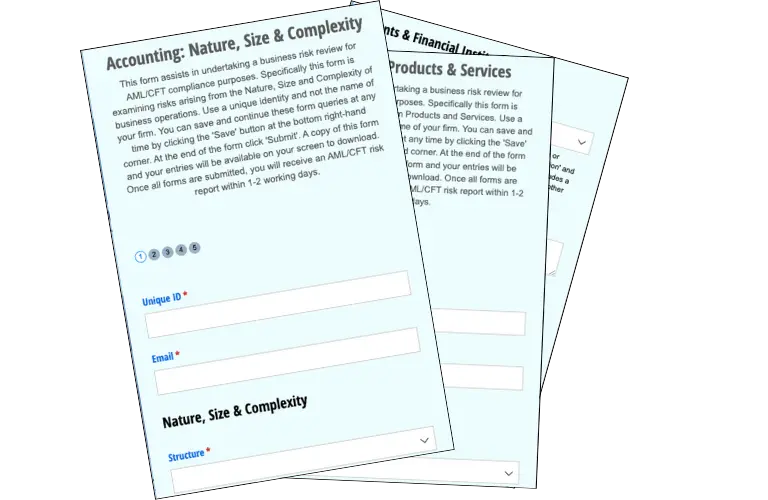

Keep Compliance Effective And Low Cost with Digital Forms

Remove risk-based reporting complexities, reduce costs and automate compliance workflows. Utilise digital forms to automate risk profiling and reporting. Configured to your sector and complexity of business. Use for AML/CFT business risk reports, client risk ratings and activity monitoring.

Automate Compliance Efficiency

AML360™ delivers configured AML/CFT forms that activate with a click to automate work flows. Embed into your AML/CFT Programme and discover affordable compliance.

What should you expect from an AML Audit NZ?

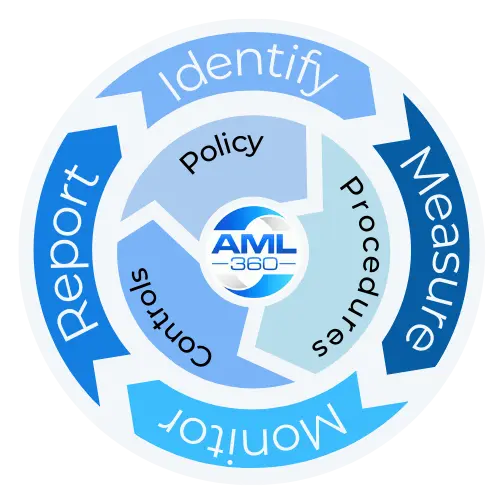

An AML audit NZ provides a business with an independent opinion on the strengths and weaknesses of an AML/CFT compliance programme. The AML audit report will analyse key aspects of AML/CFT compliance against requirements of sections 57 and 58 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. These sections relate to the AML business risk assessment and AML/CFT compliance programme.

The AML/CFT auditor will review relevant documents and test procedures to ensure the anti-money laundering business risk assessment is adequately informing the AML/CFT programme.

The auditor's experience and quality of service is reflected in the detail of the recommendations provided in the AML/CFT audit report.

Ultimately your AML/CFT auditor impacts on your exposure to an AML/CFT compliance breach.

What skills should an AML Auditor demonstrate?

To get the best results from your AML/CFT audit, your auditor should have expertise in the application of the risk-based approach to meeting anti-money laundering compliance laws. Knowledge of how to practically apply the risk-based approach is a key aspect of ensuring governance, risk and compliance controls align with the business’s nature, size and complexity.

Their expertise should incorporate designing and oversight of AML/CFT programmes. The AML auditor’s former AML/CFT roles should be at the mid to senior management level.

Preferably your AML auditor should hold a qualification in anti-money laundering compliance, along with experience in the sector that your business operates.

The level of experience of your AML auditor will dictate the quality of your AML audit and more specifically, the recommendations provided.

A quality audit can prevent compliance breaches

If your AML/CFT auditor fails to identify material weaknesses in the AML business risk assessment or AML/CFT programme, your business is exposed to regulatory action.

The best position to be in for an AML/CFT “reporting entity” is to have confidence the AML/CFT compliance framework will stand-up to close scrutiny from an AML/CFT Supervisor. When you have met that level of AML/CFT compliance confidence, you are in a good position.

AML Audit NZ

How much does an AML Audit NZ cost?

The nature, size and complexity of your business will reflect in the cost of an AML audit. An AML/CFT audit requires the auditor to utilise their subject matter expertise, review documents, interview staff, test policy, procedures and controls and complete an AML/CFT audit report. The AML audit report will set out the opinion and findings, along with any recommendations.

The audit costs also depend on whether the reporting entity elects a ‘limited’ or ‘reasonable’ assurance report.

Small businesses can expect to pay around $1,500 for a limited assurance audit.

How long does an AML/CFT Audit Take to Complete?

An AML/CFT Audit will typically take between 1-3 months to complete.

The timeframe for completing an AML/CFT audit will depend on several factors. This includes the resourcing levels of the AML Auditing firm, as well as the resourcing commitments provided by the business entity.

Your date deadline for the AML/CFT Audit Report should be discussed with your auditor.

AML Audit NZ - Reasonable or Limited Assurance?

The AML/CFT Supervisors have provided a Guideline on AML Audits. The commitment of resourcing and testing of a reasonable assurance audit is greater.

Reasonable assurance audits provide greater confidence that the audit has adequately tested AML/CFT policy, procedures and controls. You can access the AML audit guideline at the links below:

Internal Reporting

We provide a framework to assist with an internal review and reporting structure. Known as the AML Compliance Health Check, references to New Zealand’s anti-money laundering compliance laws are provided. Your business will increase knowledge of how to structure an internal reporting system.

Does an AML Auditor need to hold an AML/CFT Qualification?

No, an AML/CFT auditor is not required to hold an AML/CFT qualification. However, AML/CFT Supervisor Guidelines require that the AML/CFT Auditor detail their relevant experience in the covering AML/CFT Audit Report.

The more qualified and experienced the AML Auditor is in performing the AML Audit, the greater the level of confidence that AML/CFT Supervisors will place on the AML Audit Report. Links to AML/CFT Supervisor Guidelines are available at the top of this page.

AML Auditor Considerations

This is a further article on matters to consider when selecting an AML auditor.