Easily keep track of matters that require actioning and set the priority level and due date. Never miss a deadline again.

Importance of AML Case Management

Laws for Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT), require significant administrative duties. Administrative duties include onboarding clients, client risk profiling, monitoring of client activity, and reporting to management.

An AML Compliance Management solution enables Anti-Money Laundering Compliance Officers to record all their compliance functions, then track and report on the current status.

Benefits of AML Case Management

By organising anti-money laundering compliance tasks with a priority status, an Anti-Money Laundering Compliance Officer will perform their duties with greater efficiency.

An AML/CFT Compliance Management system will reduce the risk of missing deadlines or failing to action a case priority.

The ability to track, monitor and report from a key-board improves compliance assurance.

Features of AML Case Management

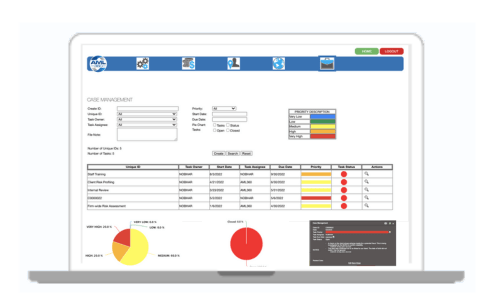

AML360’s AML/CFT Case Management solution provides an Anti-Money Laundering Compliance Officer (AMLCO) with the ability to assign tasks to staff, set priorities and confirm the deadline date.

Logging into the AML/CFT Compliance Management register will display charts to show the priority cases and the current status.

Anti-Money Laundering Reporting Officers can update file notes and authorise important records.

Eliminate Email Chains with AML Case Management

Email communications are handy but when it comes to anti-money laundering compliance and preparation of AML/CFT audits, emails can be problematic.

Email communications are buried amongst many communications. When an AML/CFT auditor requests confirmation of a specific compliance function, a lot of time can be wasted in trying to retrieve the email correspondence.

AML/CFT Case Management provides a centralised data storage of all AML/CFT compliance actions.

AML Case Management Reporting

AML/CFT Supervisors and AML/CFT Auditors expect senior managers (including Board members) to have knowledge of the business entity’s AML/CFT compliance performance.

AML/CFT Case Management provides Anti-Money Laundering Compliance Officers with the ability to instantly provide management reporting by using informed data.

The ability to provide management reports at the click of a button saves significant resourcing and time.

Improve Complance Efficiency

Confirming responsibilities and priority actions through an AML Case Management system, will demonstrate good governance.

Gain confidence in meeting anti-money laundering compliance obligations by utilising a simple tracking, reporting and monitoring compliance solution.

Organise and Prioritse

The ability to organise and prioritise compliance obligations becomes seamless with AML360 regulatory technology.