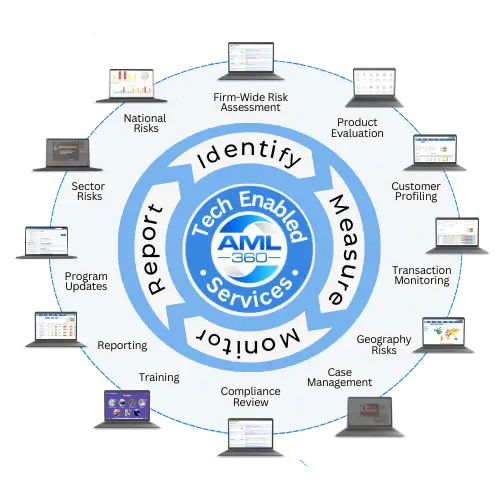

AML360™ automates compliance complexities and provides your firm with structured risk-based reporting.

How to Thrive In an Independent AML/CFT Audit

Independent AML/CFT Audit NZ. We provide specialist advisory services to strengthen your performance in meeting regulatory expectations of anti-money laundering laws. We enhance your compliance processes with practical, low cost and easy-to-implement anti-money laundering compliance solutions. Experience Low-Cost AML/CFT Compliance Efficiency.

How to prepare for an independent AML/CFT audit

Preparing for an anti-money laundering compliance audit can be daunting. Lack of record keeping is often found to be problematic during an AML/CFT audit.

The AML/CFT Compliance Officer should be prepared to demonstrate the day-to-day practice that its firm applies in meeting Know Your Customer and client onboarding processes, including the systems relied on for ongoing monitoring and reporting.

AML Risk Assessments

The AML/CFT business risk assessment must be up-to-date and incorporate information from your AML/CFT sector risk assessment and the AML/CFT national risk assessment.

Each version of the AML business risk assessment should be maintained for a period of at least 5-years.

A document management table should show a summary of the updates, the version number and those responsible for authorising the sign-off.

AML/CFT Reviews

Your independent audit for anti-money laundering will have better results if your firm utilises systems for conducting internal AML/CFT reviews. These reviews should be in writing and detail the findings, along with the appropriate remedial action taken (if any).

The regulatory expectation is that an in-depth anti-money laundering compliance review should be undertaken on at least an annual basis. If your business is complex or operates with high inherent risks, AML/CFT reviews should be conducted more frequently.

How to get the most from your independent AML/CFT Audit

If your AML/CFT auditor fails to identify material failures in the AML business risk assessment or AML/CFT programme, your business is exposed to regulatory action.

When selecting your auditor for the independent AML/CFT audit, ensure they have experience in the application of the risk-based approach, along with subject matter expertise in anti-money laundering and countering the financing of terrorism. An independent AML/CFT audit will have a better result for your business when these crucial skills are possessed by your AML/CFT auditor.

How much does an AML Audit cost?

Whether your business requires a limited or reasonable assurance audit will reflect on final costs. A reasonable assurance AML/CFT audit requires greater resourcing which results in an increased fee in comparison to a ‘limited’ assurance AML/CFT audit.

Anti-Money Laundering Consultants Ltd provides an AML/CFT ‘limited’ assurance audit for small businesses for $1,500 (+gst).

Guidelines for an independent AML/CFT Audit

Your AML/CFT Supervisor has provided a Guideline on AML Audits. You can access the AML audit guideline at the links below:

Internal Reporting for Independent AML/CFT Audit

We provide a framework to assist with an internal review and reporting structure. Known as the AML Compliance Health Check, 70+ typical hotspots are measured. Your business will receive a report to detail each of these hotspots. References to New Zealand’s anti-money laundering compliance laws are provided. Your business will increase knowledge of how to structure an internal reporting system.

AML Auditor Considerations

This is a further article on matters to consider when selecting an AML auditor.

Does an AML Auditor need to hold an AML/CFT Qualification?

No, an AML/CFT auditor is not required to hold an AML/CFT qualification. However, AML/CFT Supervisor Guidelines require that the AML/CFT Auditor detail their relevant experience in the covering AML/CFT Audit Report. The more qualified and experienced the AML Auditor is in performing the AML Audit, the greater the level of confidence that AML/CFT Supervisors will place on the AML Audit Report. Links to AML/CFT Supervisor Guidelines are available at the top of this page.