When updating your business AML Risk Assessment, don't exhaust your valuable human resourcing. AML360 provides a simple form for you to complete. Your report results are comprehensive with application of the regulatory risk-based approach to AML/CFT compliance.

Looking for an Affordable and Effective NZ AML Risk Assessment?

Don't struggle with any AML risk assessment. Remove risk-based reporting complexities and use simple steps to receive a customised AML risk assessment report.

We ensure affordability so your business can controls its AML/CFT compliance costs.

What should you expect from an AML Risk Assessment?

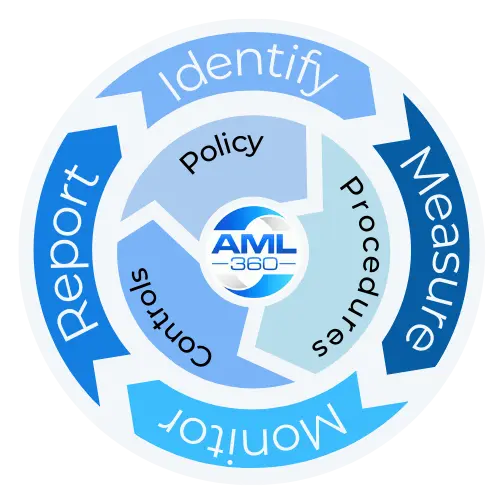

AML/CFT laws that apply the regulatory risk-based approach, have the expectation that the AML Risk Assessment will drive the efficiency of Policy, Procedures and Controls.

For these reasons, the AML Risk Assessment is considered to be the primary foundation to an AML/CFT compliance framework.

How does the AML Risk Assessment Drive Policy, Procedures and Controls?

Organised criminals and those that participate in crime, look for ways to hide their criminal activity. Accordingly, money launderers can utilise sophisticated methods to avoid detection. To achieve that purpose, those that seek to commit these crimes will ‘shop around’ for businesses that offer the best means to avoid detection.

Financial criminals will look for businesses that operate with weak AML/CFT policies, procedures and controls. They will also seek those businesses that have favourable products and/or services.

Accordingly, the Financial Action Task Force (the FATF) sets recommendations that apply risk-based principles.

One of the AML/CFT risk-based principles that FATF sets is for business owners and operators to understand their AML/CFT risks. Accordingly AML/CFT laws require business owners to evaluate (a) the types of customers that they market to, (b) the types of products and services that they distribute, (c) including the method of distribution, (d) and the geographical reach of the business.

The above are the basic international standards of risk elements that exist within a business.

To meet risk-based principles, the assessment process must be adequate. The importance on ‘adequacy’ and/or ‘effectiveness’ recognises the link that the risk assessment has to the adequacy of policies, procedures and controls.

An AML Risk Assessment is the strongest component to an AML/CFT Programme

Once the higher risk exposures across business operations are known, the expectation is for businesses to use that information for the development of effective policies, procedures and controls that manage and mitigate the risks.

Therefore if a business has high inherent risks, the AML/CFT Programme (Policies, Procedures and Controls) have the purpose of reducing risks to an acceptable level. Most importantly, the AML/CFT Programme should have capability of alerting suspicious activity.

However, if a business misses a single incident of ML/FT, it does not mean that the AML/CFT Programme has failed. The AML/CFT Programme needs to be able to demonstrate ‘reasonable adequacy’.

How much does an AML Risk Assessment Cost?

When considering the costs of an AML Risk Assessment, your business should consider the human resourcing factor, as far as how many hours a staff member may spend on preparing and updating a risk assessment.

If the staff member is not an AML/CFT risk specialist, it is likely they will spend many hours updating themselves with legislative requirements, as well as AML/CFT Sector assessments and the National Risk Assessment. They also need to be familiar with typologies (methodologies) used for money laundering and/or financing of terrorism. They must have knowledge of how to apply a reasonable risk-based approach to their evaluation and the risk-based approach must be in writing.

If a business does not have internal expertise and they do not have the resourcing capability to commit staff to the AML risk assessment, external expertise is a further option.

AML/CFT Advisory firms and AML/CFT consultants specialise in providing AML/CFT risk assessments.

AML/CFT Advisory Firms and Consultants will consider the complexity of the business, the size of the business, the types of products and services and the geographic reach.

The costs of advisory firms range from $1,500 to $10,000 for development of an AML Risk Assessment.

How Can AML360™ Regulatory Technolgoy Reduce Costs >50%?

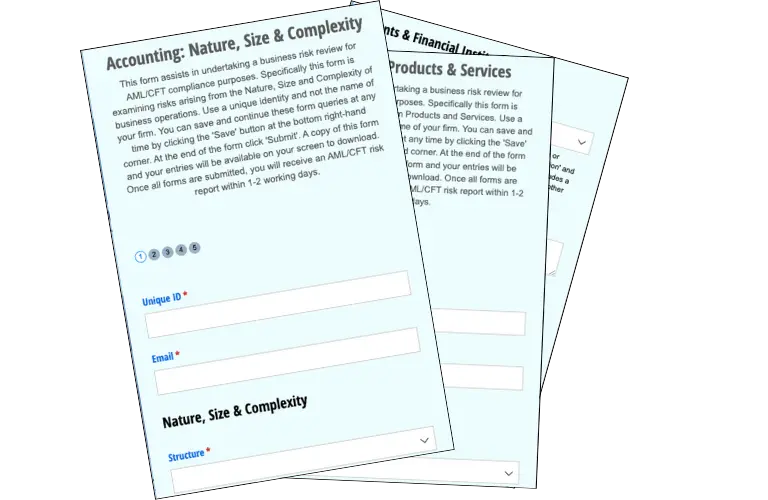

A further option is to allow AML360™ to provide your firm with regulatory technology to complete an AML Risk Assessment.

Using AML/CFT regulatory technology your staff can take control of the business AML/CFT risk reporting responsibilities. The technology takes care of the subject matter expertise.

AML360™ has the ‘think engine’ embedded into your online form. All your staff member needs to do is select data options on screen, add information to questions and ‘Submit’. Your firm will subsequently receive a comprehensive AML/CFT Business Risk Report. Your report incorporates an Appendix Guidance Manual that refers to relevant information from your AML/CFT Supervisor’s Sector Risk Assessment.

With a ‘Point and Click’ function, your business receives an AML Risk Assessment Report for $495 (+gst). The AML Risk Assessment report will adequately inform your business of the types of risks that must be considered under the AML/CFT Act and regulations.

Internal Reporting

The AML/CFT Risk Assessment Report can be used to inform AML/CFT Compliance Officers, Senior Managers, Risk Executives, Board Members, Auditors and AML/CFT Supervisors. system.

How Reliable is the AML360™ Risk Assessment?

The AML360™ AML Risk Assessment software is developed with risk-based AML/CFT compliance principles. The reporting is designed to be fully informative and the technology is flexible to align to changes in laws and/or regulations and/or Codes of Practice or Guidelines.

Thresholds are customised to industry sector.

AML Auditor Considerations

AML/CFT Auditor and your AML/CFT Supervisor recommendations are easily incorporated.

Experience AML/CFT regulatory technology and reduce costs >50%.