Free compliance tools from your AML Auditor

As your AML auditor, we provide FREE access to compliance solutions designed to boost your knowledge and expertise for monitoring AML/CFT compliance risks. Your AML compliance officer will gain helpful insight for structuring ongoing reviews and evaluating compliance risks.

aml360.co.nz

AML Auditor and AML Auditing Guidelines

Reasonable assurance audits provide greater confidence that the audit has adequately tested AML/CFT policy, procedures and controls. You can access the AML/CFT Supervisor Audit Guidelines at the links below:

Selecting your AML Auditor

When you engage our services as your AML auditor, we provide you with informed techniques of how to perform best practice AML/CFT compliance. This includes FREE AML compliance tools designed to boost your AML/CFT compliance knowledge.

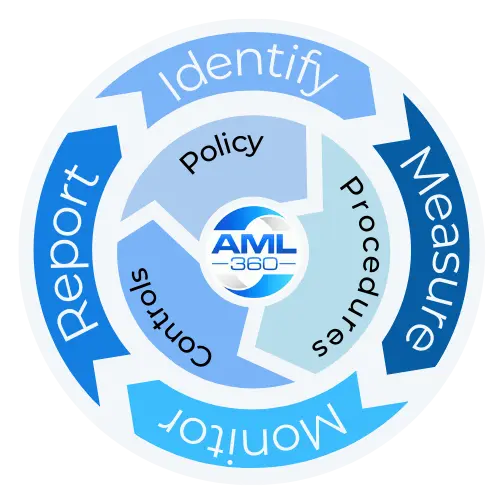

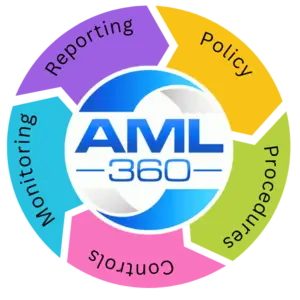

AML/CFT Programme

Your AML/CFT compliance programme is required to demonstrate the policies, procedures and controls that your firm relies on to meet AML/CFT regulatory expectation. Our FREE compliance tools provide you with deep insight in managing and maintaining an AML/CFT compliance programme.

AML/CFT Risk Assessments

An AML/CFT business risk assessment is the first foundation when developing and maintaining an AML/CFT compliance programme. Your audit includes a customised AML/CFT business risk report. The report provides you with the ability to compare results against your existing assessment. Your report includes heat maps to easily identify the higher-risk areas across your business. A risk-based guidance manual is included to explain the methodology.

Use the results of the AML/CFT business risk report to compare against your AML/CFT business risk assessment.

Read this article for some tips on what an AML auditor may consider when reviewing AML risk assessments.

Products / Services Risks

We also provide a risk rating report for individual products and services. The risk rating of products and services is a regulatory expectation. Product and services risk is linked to adequate and effective ongoing monitoring. Use this free tool to risk evaluate your current products and/or services against ML/FT risks.

Get a FREE AML Product Risk Report.

Customer Risks

Under risk-based anti-money laundering compliance laws, customer risk profiling is a mandatory obligation. Customer risk profiling means more than identity verification and screening.

Anti-money laundering compliance requires the application of Customer Due Diligence (CDD). CDD for anti-money laundering and countering the financing of terrorism, requires knowledge of the individual risk characteristics of a customer or client.

We provide your business with an option to test a client risk methodology. No customer identity or other biological data is required. Your business can use the results reports to assist with the development of customer risk profiling methodology. If your firm already has a customer risk profiling methodology in place, you can use the free sample profile reports for comparative analysis.

Activity Monitoring

We allow you to test your activity or transaction data against the rules designed for red flag alerts. This data test will provide reassurance if your existing rules meet the regulatory expectation of adequate and effective.

Internal Reporting

We provide a framework to assist with an internal review and reporting structure. Known as the AML Compliance Health Check, 70+ typical hotspots are measured. Your business will receive a report to detail each of these hotspots. References to New Zealand’s anti-money laundering compliance laws are provided. Your business will increase knowledge of how to structure an internal reporting system.

AML Auditor Considerations

This is a further article on matters to consider when selecting an AML auditor.

Does an AML Auditor need to hold an AML/CFT Qualification?

No, an AML/CFT auditor is not required to hold an AML/CFT qualification. However, AML/CFT Supervisor Guidelines require that the AML/CFT Auditor detail their relevant experience in the covering AML/CFT Audit Report. The more qualified and experienced the AML Auditor is in performing the AML Audit, the greater the level of confidence that AML/CFT Supervisors will place on the AML Audit Report. Links to AML/CFT Supervisor Guidelines are available at the top of this page.