How to Maintain an AML/CFT Business Risk Assessment

How to maintain an AML/CFT Business Risk Assessment

This article discusses the key aspects of establishing and maintaining an AML/CFT Business Risk Assessment.

AML Risk Assessment

An AML/CFT Business Risk Assessment provides Anti-Money Laundering Compliance Officers with details of the inherent risks of facilitating money laundering and terrorism financing.

An AML Business Risk Assessment will examine the (a) nature, size and complexity of the business, (b) the types of products and services offered to clients, (c) risk characteristics of clients (B2B and B2C) and their transactions, (d) the methods used to facilitate the distribution of products and services and (e) country risks of jurisdictions that the business connects with.

What are the outcomes of an AML/CFT Business Risk Assessment?

Anti-Money Laundering Compliance Officers are obligated to understand the likelihood of the business being targeted to facilitate money laundering or financing of terrorism.

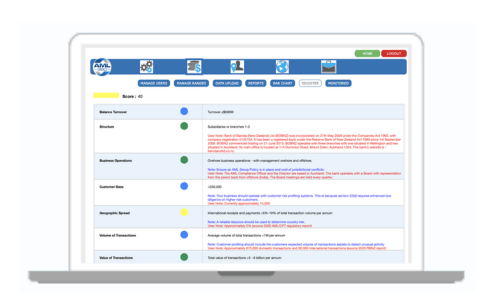

The AML Business Risk Assessment must use a reliable risk methodology that results in an informed outcome for measuring risks.

What is the AML/CFT Risk Methodology for Measuring Business Risks?

There is no standardised risk methodology for measuring business vulnerabilities of facilitating money laundering or terrorism financing.

Anti-Money Laundering Compliance Officers are guided by AML/CFT laws on what areas of business should be examined. AML/CFT Supervisors also provide further guidance, as well as Sector Risk Assessments.

The risk methodology applied must be adequate. AML Auditors will examine whether the outcomes of the AML/CFT Business Risk Report are reasonable.

AML/CFT Risks - Products/Services

Anti-Money Laundering and Countering Financing of Terrorism compliance laws require the examinination of risk vulnerabilities of Products and Services.

Products and Services are a key exposure in examining the likelihood of a business being targeted to facilitate money laundering of financing of terrorism.

Risk vulnerability increases if the Product or Service provides ownership obscurity such as pooled assets or accounts offering complex ownership structures of a business or transaction.

Cash intensity is another risk, along with transactions involving multiple jurisdictions.

The AML/CFT Business Risk Assessment should examine risks presented from products and services generally, as well as individual product/service AML/CFT risk reports.

Knowing the risk rating of individual products and services assists in ongoing monitoring and understanding overall risks presented by clients.

Reviews of AML/CFT Business Risk Assessment

To meet regulatory expectations, the AML Business Risk Assessments should be reviewed at least annually. However the frequency of AML business risk reviews will depend on the nature and complexity of the business, the risk level and whether there have been any material changes to business operations or changes to AML/CFT regulations.

Industry AML/CFT Sector Risks

New Zealand’s AML/CFT Supervisors provide sector risk assessments. Results of these sector risk assessments must be incorporated in the AML/CFT Business Risk Report.

How Can AML360™ Assist AML/CFT Business RIsk Assessments?

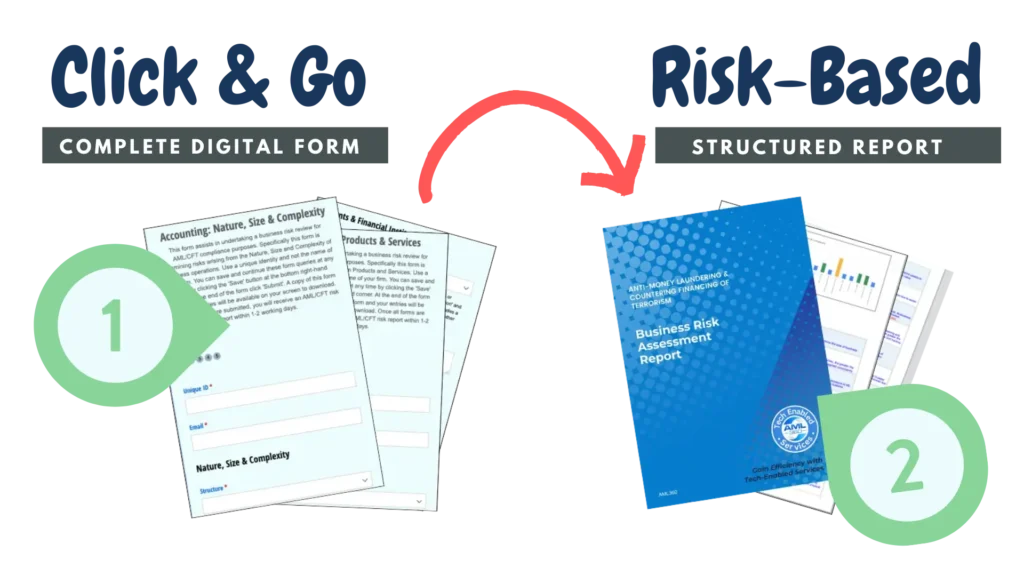

Businesses can easily maintain their business risk assessments for anti-money laundering compliance with AML360 software. The AML Software is configured to identify ML/FT risks across business operations with structured reporting. Users of AML360 only need to select data options on the screen and add notes.

Small businesses can expect to complete their AML360 business risk assessment within 20-30 minutes. A structured AML/CFT Compliance Risk Report is sent to your email, along with heat maps for management reporting

Visit our Blog or find out more about AML Software for AML Business Risk Assessments.