Simplify AML/CFT compliance by removing complexities and automating structured risk-based compliance reporting.

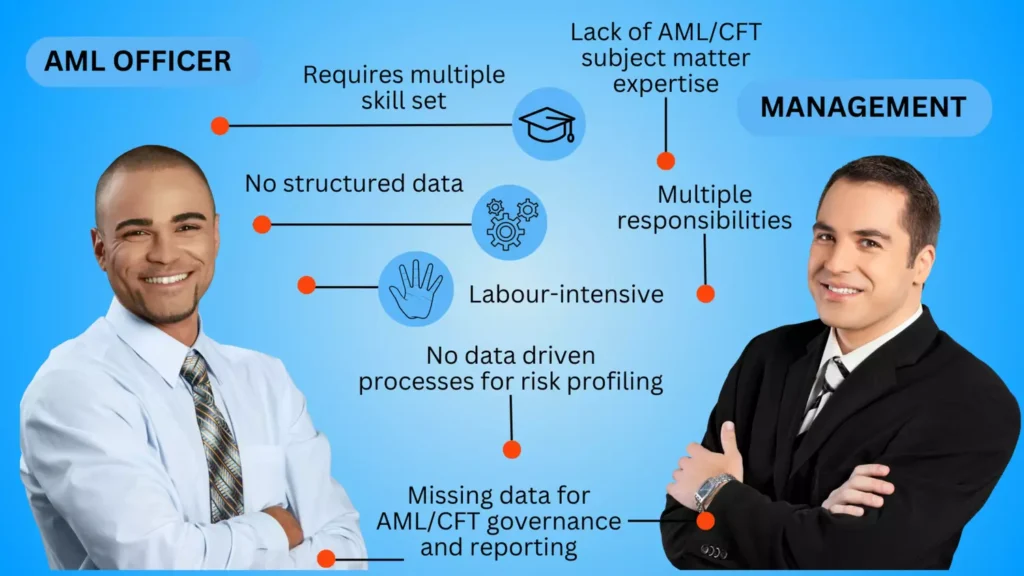

Why Do AML/CFT Compliance Officers Struggle?

The AML360™ AML/CFT Compliance Platform operates to the same level of expertise (or better) as a professional Anti-Money Laundering Compliance Officer. The easy-to-use platform automates complex anti-money laundering compliance processes. This includes AML/CFT business risk assessments and risk reporting, client risk profiling and monitoring of internal 'red flag' alerts.

What are the requirements of AML/CFT Compliance?

Anti-Money Laundering Compliance has many repetitive administrative duties. Most importantly, decision-making needs to be informed and risk-based. This high-level intensity of data management requires risk profiling and management reporting.

AML360 regulatory technology was developed for AML/CFT compliance professionals. The technology automates processes of meeting AML/CFT regulatory requirements. Offered as an affordable and digital anti-money laundering compliance programme, Anti-Money Laundering Compliance Officers can simplify complex processes with automated workflows.

Configured to Regulatory Risk-Based Reporting

AML/CFT Compliance Experts customise and test configurations against regulatory expectations and application of the risk-based principles.

Your anti-money laundering compliance officer can take full control of the anti-money laundering compliance framework from a keyboard.

Fully customised to the nature, size and complexity of a business entity, AML360 Regulatory Technology performs complex processes and instantly reports.

The subject matter expertise of anti-money laundering structured reporting is embedded in the AML360 platform. The platform acts as an Advisory and Reporting AML/CFT compliance framework.

End-to-End AML Compliance Solution

An end-to-end AML/CFT compliance framework can be configured, tested and delivered within 2-3 business days.

Individual AML/CFT Software modules such as the AML/CFT business risk assessment, product/service risk evaluation and checking on the internal strengths and weaknesses are provided immediately.

As an end-to-end AML Software delivered as a platform, AML360 performs at the same level of subject matter experts in compliance strategies for anti-money laundering and countering financing of terrorism.

Plug & Go or Customise

AML/CFT compliance professionals can use Plug & Go or customise. Our Plug & Go includes automated customisation. AML/CFT Compliance Experts can use their preferred methodology with AML360’s customised options.

All of AML360 solutions convert AML/CFT compliance reporting into digital processes. This saves your firm time and money. Additionally, compliance efficiency is enhanced with a tested solution.

AML/CFT Risk Identification

The starting position for businesses that are subject to anti-money laundering compliance laws is to complete an AML/CFT business risk assessment.

The AML firm-wide risk assessment must identify the risk characteristics of business operations that present exposure to facilitating money laundering and/or financing of terrrorism. This includes (a) the nature, size and complexity of business operations, (b) client relationships (B2B and B2C), (c) the types of products and/or services delivered to clients, (d) the methods of how products/services are delivered and (e) the geographies dealt with.

The AML risk assessment must reasonably inform business owners, managers, executives and the AML/CFT compliance officer.

The AML business risk report must adequately explain the risks relating to money laundering (ML) and financing of terrorism (FT).

By being adequately informed of ML/FT risks, the business is better equipped to develop policies, procedures and controls to combat ML/FT.

AML360 technology provides a professional AML/CFT business risk assessment report. Adopting AML/CFT Supervisor recommendations, AML Compliance Officers simply select data on screen, add notes and click ‘Calculate’.

Products / Services Risks

The AML/CFT business risk assessment should be supported with individual risk reports for each product and service offered.

The risk evaluation of products and services assists in client risk profiling and setting parameters for identifying ‘red flag’ client activity.

AML/CFT Client Risk Profiling

From 1 June 2025, New Zealand’s AML/CFT Supervisors require all clients to have an individual client risk rating.

AML360 can perform customised client risk profiling effortlessly and at affordable fees. We provide options for an AML/CFT customer risk analysis report informing of risk characteristics across the entire customer base. We also provide an option for an online client risk register that holds individual risk profile reports for every client.

Most importantly this service is affordable to all small and medium-sized businesses.

AML/CFT Compliance Monitoring

The primary objective of anti-money laundering and countering financing of terrorism laws is for businesses to identify suspicious client activity. The methods adopted must be adequate and effective. Procedures and reporting structures must inform of real risks.

Ongoing anti-money laundering compliance and monitoring requires the application of client risk profiling. Other risk profiling obligations include product/services AML/CFT risk assessments and setting of AML/CFT rules to detect suspicious activity that may indicate money laundering and/or financing of terrorism.

Ongoing monitoring is one of the most expensive aspects of the anti-money laundering compliance framework. AML360 provides affordable solutions for ongoing monitoring and automated reporting. More importantly, AML360 is recognised for its AML/CFT compliance efficiency which assists your business to protect brand and reputation.

Internal AML/CFT Compliance Reviews

AML/CFT Auditors and AML/CFT Supervisors expect businesses to demonstrate systems in place for AML/CFT compliance reviews.

An AML/CFT compliance review must be undertaken at least annually. If a business operates with complexity and higher ML/FT risks, these reviews should be undertaken with greater frequency.

As an end-to-end anti-money laundering compliance solution, AML360 provides many options for simplified, low cost and effective AML/CFT compliance reporting.

AML/CFT Audit Preparation

Record keeping is vital for meeting anti-money laundering compliance obligations. AML/CFT compliance inspections require demonstrations of AML/CFT compliance processes. These processes need to be well documented. To an AML/CFT Supervisor or AML/CFT Auditor, if record keeping cannot be demonstrated, an AML/CFT compliance breach is likely.

All businesses that are subject to AML/CFT compliance must operate with an AML/CFT compliance framework that includes the ability to detect strengths and weaknesses in the AML/CFT programme.