A Client Risk Rating is a regulatory obligation of risk-based laws. AML360™ streamlines your development and implementation of client risk rating reports.

Establish AML Client Risk Profile Reports with AML360™

The ability to report on an individual AML client risk profile is fundamental in determining whether client activity is expected or unusual. The Risk-Based Approach to decision-making should be demonstrated with AML/CFT Profiling and Reporting.

Country Risks

Sanctions, Terrorism, Money Laundering.

Audit Management

Record keeping, compliance reporting.

Incident Reporting

Track, monitor and remediate.

Ongoing Monitoring

Digital AML/CFT Compliance Officer.

Compliance Reporting for AML Client Risk Profile

AML360 provides your firm with a simple and low-cost solution for meeting anti-money laundering (AML/CFT) compliance obligations.

Our AML Client Risk Profile solution is customised to the nature, size and complexity of your business.

AML360 incorporates every aspect relevant to an AML/CFT Client Risk Profile report. The solution application incorporates the regulatory risk-based approach.

Get a FREE TRIAL

AML Client Risk Profile

Risk-Based Anti-Money Laundering (AML) compliance requires consideration of individual AML client risk profiling. The expectation is for Anti-Money Laundering Compliance frameworks to operate with a client risk profiling and reporting system.

Client risk profiling is an ongoing obligation. AML/CFT Compliance Programmes need to have policy, procedures and controls in place for an effective AML Client Risk Profile reporting, with management function.

Knowing “Risk” provides an opportunity for businesses to place their resources in the areas that need resourcing the most.

If a business is not able to identify their high-risk base of clients, then regulatory expectation is unlikely to be met.

AML/CFT Auditors will expect to examine the adequacy of a client risk profiling methodology.

AML/CFT Supervisors provide written guidelines to assist business to interpret regulatory objectives.

AML Client Risk Profile Reports

To reduce operational business costs, AML/CFT Compliance frameworks should utilise automated solutions and eliminate labour-intensive processes.

AML/CFT Supervisors are increasing regulatory expectation for the performance of governance and reporting of AML/CFT regulatory obligations.

From 1 June 2025, all businesses captured under New Zealand’s Anti-Money Laundering and Countering Financing of Terrorism Act, are expected to operate with AML/CFT client risk profiling policies, procedures and controls.

AML360 provides your firm with a white-label to establish your Anti-Money Laundering Compliance solutions. Your customised compliance solution is fully tailored to your AML/CFT compliance risk appetite and AML/CFT compliance complexities.

What is the Cost of an AML Client Risk Profile Solution?

AML360 Software is low-cost compliance and effective governance for a reporting solution.

For small businesses, the annual cost is $1,999. An additional one-off development and testing fee is required. Updates are automated with no additional fee.

Anti-Money Laundering Compliance Officers will perform with greater efficiency using AML360’s automated solutions.

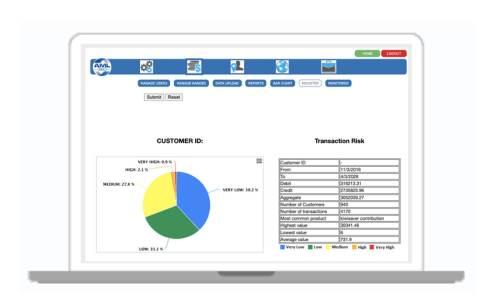

What Data is Required for AML Client Risk Profile Reporting?

Data relevant to products and services, including the nature and purpose of the client relationship should be incorporated into an AML Client Risk Profile Report.

Geography risks relevant to the country of birth, countries of residence and citizenship, as well as countries where transactions take place, are all relevant to establishing client risk profiling under risk-based reporting.

The volume and value of a customer’s activity, including average value transactions and/or cross-border activity should be established to support ongoing monitoring reporting obligations.

Testing Methodology of AML Client Risk Profile

The outputs of compliance risk profiling should adequately inform the basis of the AML/CFT client risk rating.

Updates and reviews of client risk profiling must consider account activity.

Ultimately the client risk profile should assist a business to quickly determine if detected ‘red flags’ are a true suspicious activity.

Being informed from relevant client risk data will enable AML/CFT Compliance Officers to quickly determine if a matter should be escalated.

How Can AML360 Assist with AML/CFT Compliance Reporting?

AML360 regulatory technology automates risk analysis using AML/CFT expertise and internationally accepted best practice for risk-management reporting.

AML360’s solutions provide Board members with information relevant to the company’s AML/CFT compliance status.

Improve compliance efficiency with a tested and reliable AML/CFT Compliance Solution.

Get in Touch and Request a FREE Demonstration.