Automating AML/CFT compliance processes and procedures will significantly reduce compliance costs and improve AML/CFT efficiency.

Administer a Digital AML Programme NZ

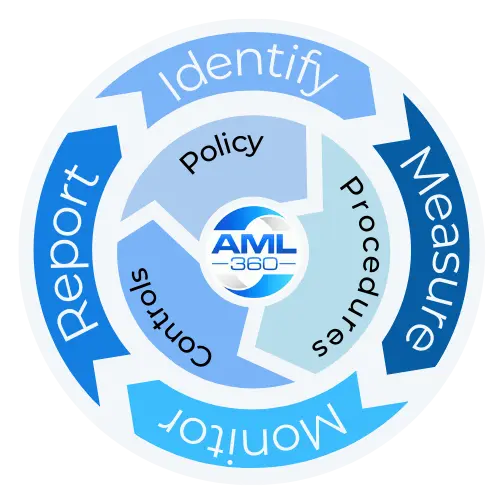

An AML Programme NZ refers to a firm’s policies, procedures and controls for managing anti-money laundering compliance. Also referred to as an AML/CFT Programme, it represents how businesses conform to regulatory expectations of AML/CFT compliance responsibilities. These regulatory compliance responsibilities are established by the Anti-Money Laundering and Countering Financing of Terrorism Act.

Go Digital with AML Software

AML360 Software is configured by anti-money laundering compliance specialists to automate regulatory workflows and compliance reporting. By transitioning to regulatory technology, AML Software eliminates complex and labour-intensive processes. By reducing human resourcing commitment, your business will reduce AML/CFT compliance costs, and gain AML/CFT compliance efficiency.

Automate Pocedures and Processes in AML Programme NZ

Every aspect of an AML/CFT compliance framework can be automated with work flows designed for compliance efficiency and streamlining business operations.

Anti-Money Laundering Compliance Officers can effectively manage their compliance responsibilities by logging into the AML360 Platform and execute compliance updates and reporting.

Gain Benefits from AML Regulatory Technology for AML Programme NZ

Regulatory technology is configured to conform to expectations under anti-money laundering compliance laws.

AML Regulatory Technology eliminates labour-intensive processes and enables AML Compliance Officers to operate with an organised and structured compliance framework.

Eliminate Paper From Your AML Programme

AML360’s solution to an AML Programme NZ enables staff to collaborate online.

The AML Programme has embedded workflows including customer onboarding forms and management reporting to inform on the compliance status.

Version control is easily administered, so too are updates.

Guidelines for an Independent AML/CT Programme

AML/CFT Supervisors have provided a joint Guideline on what should be considered when establishing and maintaining an AML/CFT Programme. You can access the AML/CFT Programme Guideline at the links below:

Monitoring Effectiveness of the AML/CFT Programme

The policies, procedures and controls applied by a business entity should be tested for strengths and weaknesses. Testing should occur at least on an annual basis.

The purpose of the testing is to confirm if any parts of the AML/CFT Programme require amending.

AML/CFT Auditors will want to inspect the systems relied on for ensuring the AML/CFT Programme is operating as expected.

How Can AML360™ Assist with an AML/CFT Programme?

AML360 regulatory technology combines policy writing, as well as the structured AML/CFT compliance procedures and controls required to conform to AML/CFT regulations.

Get More Information or go to the AML360 website.