A Client Risk Rating is a regulatory obligation of risk-based laws. AML360™ streamlines your development and implementation of client risk rating reports.

AML Software KYC & Client Risk Profiling

AML360 streamlines anti-money laundering compliance workflows with AML Software KYC (Know Your Customer). Our AML/CFT Compliance professionals assist your business in executing individual client risk profiling or AML/CFT risk reporting across the entire client base.

How Does AML Software KYC Assist AML/CFT Compliance?

Know Your Customer (KYC) requires risk profiling for the assessment of a client’s exposure to facilitating money laundering or financing of terrorism.

AML Software KYC utilises data science and risk management. To be effective, AML/KYC Client Risk Reports must be customised to the nature, size and complexity of the client’s business.

If businesses do not use automated data risk profiling, they are likely to be operating with labour-intensive processes. When AML/CFT Compliance relies on labour-intensive processes, AML/CFT Compliance costs with significantly increase.

AML Software KYC reduces compliance burdens and ongoing operational business costs.

Type of AML/CFT Client Risks

An AML/CFT client risk profile provides a risk rating of the client’s exposure and/or probability, of facilitating money laundering and/or financing of terrorism.

It is important to recognise that AML/CFT laws do not prevent business with High or Very High-risk clients. Unless there is a mandatory obligation not to trade with a client, such as an economic sanction prohibition, business owners have discretion in setting their risk thresholds.

If a business by its nature operates in a higher-risk sector, AML/CFT Supervisors and AML/CFT Auditors will expect robust compliance systems for management, monitoring and reporting. In other words, ongoing monitoring for AMLCFT compliance risk and status should operate like a well-oiled engine.

KYC Profiling

At any given time, a business should be able to identify the higher-risk clients within its client base. Knowing the risk levels of clients enables businesses to demonstrate compliance with Know Your Client (Know Your Customer).

When business owners know the areas of business that present a higher risk, this allows Anti-Money Laundering Compliance Officers to effectively place resourcing effectively.

Governance, Risk and Compliance systems that operate with AML/KYC compliance monitoring, assist Board members and Risk Committees to demonstrate their AML/CFT regulatory obligations.

AML Software KYC - Customer Risks

Customer risk profiling incorporates results from identity verification and screening, as well as the nature and purpose of the client’s business relationship.

If the client is a business or commercial entity, Know Your Client’s Clients (Know Your Customer’s Customers) applies.

The inherent money laundering and financing of terrorism risks should examine the global reach of the underlying client’s business activity, as well as the types of products or services the client delivers.

If businesses that are subject to AML/CFT compliance laws fail to consider Know Your Customer’s Customer (KYCC), then they are flying blind and may unwittingly facilitate a serious financial crime and breach AML/CFT compliance laws.

Use of AML Software KYC for Risk Profiling

The significant advantage of AML Software KYC is the ability to quickly interpret risk.

AML Software KYC also allows flexibility in updating to changes in business, the industry sector or AML/CFT compliance regulations.

Heat Maps AML Software KYC

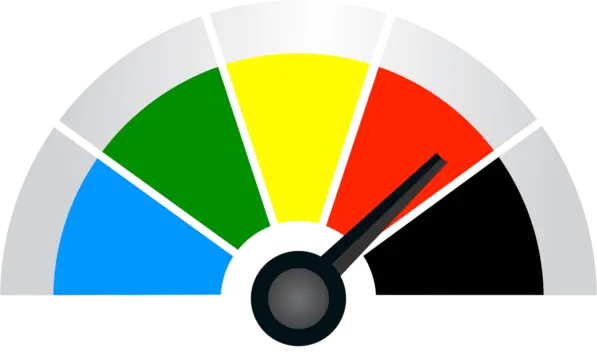

Heat Maps are an effective method to quickly interpreting client risk profiling.

AML Software KYC Heat Maps provide a snap-shot visual display of anti-money laundering compliance reporting. AML/KYC heat maps are particular useful for management reporting.

AML Software for Know Your Customer (KYC)

Whether your business is small or large, AML360 provides your firm with an effective AML Software KYC compliance tool.

We can provide individual client risk profiling reports, as well as comprehensive reporting of risks across the entire client base.

AML360 Regulatory Technology delivers your firm with compliance efficiency with low-cost AML Software.

Find Out More by visiting aml360.co.nz