Businesses must have the ability to maintain an AML/CFT Compliance Programme by identifying weaknesses in policy, procedures or controls.

Measuring AML/CFT Compliance

Laws for Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) require businesses to operate with an AML/CFT Compliance programme consisting of policies, procedures and controls. Anti-Money Laundering Compliance Officers have responsibility for ensuring the AML/CFT Programme is operating as intended and meeting regulatory expectation.

AML360 provides an easy-to-use AML/CFT Compliance Health Check, covering 70+ common hot spots.

Developing an AML/CFT Compliance Framework

An anti-money laundering (AML/CFT) compliance framework establishes the policy, procedures and controls that the business will dedicate to meeting their anti-money laundering compliance obligations.

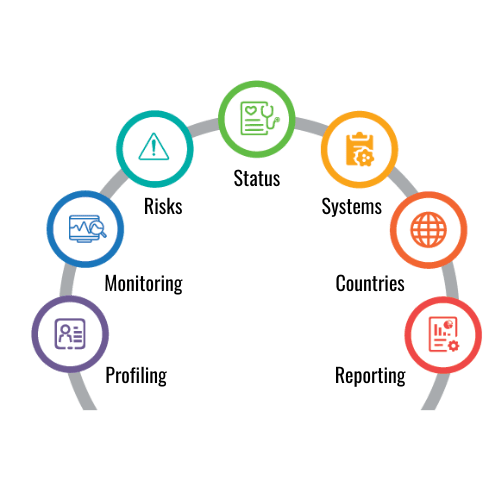

An anti-money laundering (AML/CFT compliance framework will set out how the business entity will undertake AML/CFT training, staff vetting, how customers will be verified, the type of information required to be obtained from customers and risk profiling, monitoring and reporting protocols.

An anti-money laundering compliance programme demonstrates the business entity’s commitment to meeting regulatory expectation.

Reviewing an AML/CFT Compliance Programme

The size and complexity of the business entity will reflect the frequency of undertaking an anti-money laundering compliance review.

Industry practice is for reviews to be undertaken at least once a year.

Anti-Money Laundering Compliance Officers should document how the review is undertaken, the results and any steps taken to remedy detected weaknesses.

How Does An AML/CFT Health Check Assist?

AML360’s AML/CFT Health Check has selected 70+ common hot spots known to cause problems. Often these problems are only detected at the time of an independent AML/CFT audit.

The AML360 Health Check can be used as an internal review and a Pre-Audit check of the compliance status.

References to New Zealand’s AML/CFT legislation is included, along with tips and prompts to remedy any identified weaknesses.

Strengthen AML/CFT Compliance

An AML/CFT compliance review should include the testing of ‘red flag’ alerts that the business relies on for detecting suspicious activity.

AML360 can provide your firm with a anti-money laundering transaction monitoring solution for validating and testing your rules.

AML360 also provides testing for client risk profiling.

Utilising a reliable approach when carrying out an anti-money laundering compliance review will be looked upon favourably by AML/CFT auditors and AML/CFT supervisors.

Keep Stakeholders Informed

The importance of meeting anti-money laundering compliance is relevant to protecting the brand and reputation of a business.

Business to Business (B2B) relationships often result in enquiries on what steps a business takes to ensure AML/CFT compliance obligations are being met.

The AML360 Health Check can be beneficial for many different purposes. It is an easy-to-use online platform to guide you to a compliant status.